Luxembourg Financial Regulatory News:

Understanding Your SRF Reporting Obligations (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

This guide provides a clear, step-by-step process for institutions to accurately complete the Data Reporting Form for the 2026 Single Resolution Fund (SRF) contribution period. The SRF is a critical component of the Single Resolution Mechanism, ensuring the orderly resolution of failing banks with minimal impact on taxpayers and the real economy. Annual contributions are calculated based on two components, as mandated by Article 70 of the SRM Regulation: a basic annual contribution, calculated pro-rata to the amount of an individual institution’s liabilities excluding own funds less covered deposits, and a risk-adjusted contribution, which reflects the institution’s specific risk profile.

This document is designed for compliance officers and financial reporting teams to ensure accurate and efficient reporting to their National Resolution Authority (NRA). Adherence to these instructions is critical for the correct calculation of your institution’s contribution and for maintaining regulatory compliance for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period.

1.0 Pre-Submission Essentials: Core Principles and Requirements (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

1.1. Setting the Stage: Foundational Rules for Reporting (for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period)

Before beginning data entry, it is essential to understand the foundational reporting rules. This section covers the universal requirements—from data formatting to submission protocols—that ensure your report is compliant and can be processed correctly by the Single Resolution Board (SRB).

- 1.1.1. Scope of Application

The following institutions are required to complete this reporting form at the legal entity level:

- Credit institutions: As defined in Article 4(1)(1) of the Capital Requirements Regulation (CRR), including central bodies and their affiliated institutions. This does not include entities referred to in Article 2(5) of the Capital Requirements Directive (CRD).

- Investment firms: As defined in Article 2(1)(3) of the Bank Recovery and Resolution Directive (BRRD), provided they are subject to the initial capital requirement in Article 9(1) of Directive (EU) 2019/2034 and are covered by the consolidated supervision of the parent undertaking carried out by the ECB in accordance with Article 4(1)(g) of Council Regulation (EU) No 1024/201.

Institutions authorised under Article 14 of Regulation (EU) No 648/2012 (EMIR) are out of the scope of this reporting requirement.

- 1.1.2. Key Dates and Deadlines

The data provided in Tabs 1 to 4 of the reporting form must correspond to the balance sheet date of the latest approved annual financial statements available before 31 December 2025.

- Example 1: If your institution’s fiscal year ends on 31 December, the reference date for the report is 31 December 2024 (assuming those statements are approved before the end of 2025).

- Example 2: If your institution’s fiscal year ends on 31 March, the reference date is 31 March 2025 (assuming those statements are approved before 31 December 2025).

The final submission deadline for the completed form is determined by your institution’s National Resolution Authority (NRA).

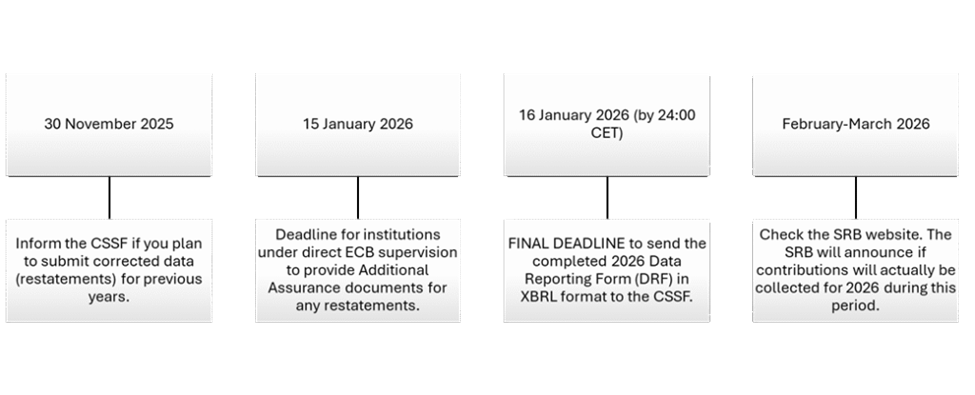

Diagram: Critical deadlines you need to meet under Circular CSSF-CODERES 25/21

- 1.1.3. Data Formatting and Default Values

Adherence to specific data formats is mandatory for successful submission.

| Rule/Value | Description |

| Monetary Amounts | Must be expressed in euros and rounded to the nearest unit (i.e., no decimals). |

| XBRL Taxonomy | Data must follow the format and specifications indicated in the XBRL taxonomy package published on the SRB website. |

| ‘0’ (zero) | Use this value when a field is applicable to your institution, but the specific fact does not occur (e.g., you have no covered deposits). |

| ‘Not available’ | Use this value when a field is applicable, but the required data is legitimately missing for a valid reason. This applies in exceptional circumstances, such as when quarterly values are not available because a banking licence was granted or withdrawn during the reference period. |

| ‘Not applicable’ | Use this value when a field is not applicable to your institution (e.g., the question in field ‘2B3’ if you do not qualify for the lump-sum contribution). |

- 1.1.4. Data Consistency and Quality Assurance

Maintaining data integrity across the report is paramount.

- Consistency with Supervisory Reporting: The data must align with information reported in the latest relevant supervisory report submitted to the competent authority for the same reference year.

- Consistency between Financial Information: All financial information must be based on consistent measurement principles as defined in the applicable accounting framework. This ensures that data across Tabs 2, 3, and 4 is comparable.

- Quality Assurance: Before submission, institutions must check that the form complies with the XBRL taxonomy’s validation rules. Your NRA may also request an additional assurance document under specific circumstances.

- 1.1.5. Submission and Post-Submission Protocol

The completed form must be returned to your National Resolution Authority (NRA) according to the modalities they define.

- Consequences of Non-Reporting: If information is not provided, the SRB will use best estimates to calculate the contribution or assign the institution to the highest risk-adjusting multiplier.

- Updates and Corrections: If submitted data requires updates or corrections, these must be sent to the NRA without undue delay. The SRB will adjust the annual contribution based on this updated information during the next contribution period.

With these core principles in mind, you can now proceed to the first tab of the reporting form.

2.0 Step-by-Step Guide to Tab 1: General Information (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

2.1. Initial Data Entry: Accurately Identifying Your Institution (for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period)

Tab 1 captures the foundational identity and contact information for your institution. The accuracy of these details is paramount for the correct processing of your submission and for all subsequent communication with resolution authorities.

- 2.1.1. Section A: Identification of the Institution

This section establishes the unique identity of the reporting entity.

| Field ID | Field Name | Guidance |

| 1A1 | Name of the institution | Provide the full, official registration name of the institution as published by the supervisor. |

| 1A2-A5 | Address Information | Enter the street, postal code, city, and ISO country code for the institution’s primary address. |

| 1A6 | RIAD code of the institution or SRB identifier | Report the unique RIAD code. If a RIAD code is not available, provide the SRB identifier as assigned by your NRA, prefixed with the ISO country code. |

| 1A7 | LEI code of the institution | Enter the Legal Entity Identifier (LEI) code. The cell format must be “Text”. |

| 1A8 | National identifier code of the institution | Enter the national identifier code as advised by your NRA. |

- 2.1.2. Section B: Contact Person

Provide details for the primary contact responsible for this report.

| Field ID | Field Name | Guidance |

| 1B1 | First name of the contact person | First name of the designated contact. |

| 1B2 | Family name of the contact person | Family name of the designated contact. |

| 1B3 | Email address of the contact person | Direct email address for the contact person. |

| 1B4 | Alternative e-mail address | An optional functional or generic email address/mailbox. |

| 1B5 | Phone number | Provide a phone number in the international format (+XX AAAA BBBBBB). |

- 2.1.3. Section C: Identifying Specific Institutional Characteristics

This section classifies your institution based on its type and activities. Your answers here determine which rules, deductions, and simplified calculations may apply later in the form.

1C1: Credit Institution Defines whether the entity is a credit institution under Article 4(1) of the CRR.

1C2: Central Body Defines an institution that supervises affiliated credit institutions under Article 10 of the CRR. If “Yes,” the entire reporting form must be completed at the consolidated level.

1C3 & 1C4: Institutional Protection Scheme (IPS) Membership Identifies if the institution is a member of an IPS that meets the requirements of Article 113(7) of the CRR. If “Yes” is also selected for field 1C4 (confirming competent authority permission), the institution may deduct certain IPS-related liabilities in Tab 3 and this will be considered in the risk adjustment calculation in Tab 4.

1C5: Central Counterparty (CCP) Identifies an institution that operates as a CCP. If “Yes,” the institution may deduct liabilities related to clearing activities in Tab 3, Section A.

1C6: Central Securities Depository (CSD) Identifies an institution that operates as a CSD. If “Yes,” the institution may deduct liabilities related to CSD activities in Tab 3, Section B.

1C7: Investment Firm Identifies an investment firm subject to a €750,000 initial capital requirement. If “Yes,” the institution may deduct liabilities arising from holding client assets or money in Tab 3, Section C.

1C8: Investment Firm with Limited Services Identifies investment firms that carry out a limited set of activities. If “Yes,” the institution qualifies for a simplified calculation method. Depending on its size, it may be eligible for the lump-sum methodology (see Section 3.1.2) or a simplified deduction calculation in Tab 3, Section G.

1C9: Institution Operating Promotional Loans Identifies promotional banks or intermediary institutions. If “Yes,” the institution may deduct liabilities arising from qualifying promotional loans in Tab 3, Section D.

1C10: Mortgage Credit Institution Financed by Covered Bonds Identifies institutions that are wound up through national insolvency procedures rather than resolution. If “Yes,” the institution qualifies for a simplified calculation method, similar to the investment firms in 1C8.

- 2.1.4. Section D & E: Special Circumstances and Reference Date

These final sections capture situational data.

- Fields 1D1 and 1D2 address reporting requirements for newly supervised institutions (those whose supervision began in 2025) and institutions that have undergone a merger after the reference date.

- Field 1E1 requires you to state the specific reference date used for the report, which must align with the rule described in section 1.1.2 of this guide.

With your institution’s identity and key characteristics established, the next step is to perform the core calculation of the basic annual contribution.

3.0 Step-by-Step Guide to Tab 2: Basic Annual Contribution (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

3.1. Core Calculation: Establishing the Foundation of Your Contribution (for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period)

The purpose of Tab 2 is to calculate the basic annual contribution before any risk adjustments are applied. This process involves reporting total liabilities, own funds, and covered deposits, followed by a critical adjustment for liabilities arising from derivative contracts.

- 3.1.1. Section A: Initial Calculation Data

Provide the following foundational figures from your approved annual financial statements.

- 2A1: Total liabilities: Report total liabilities as defined under Council Directive 86/635/EEC or IFRS. This figure represents the total balance sheet (sum of liabilities and equity items).

- 2A2: Own funds: Report own funds, defined as the sum of Tier 1 and Tier 2 capital, as per Article 4(1)(118) of the CRR.

- 2A3: Covered deposits: Report the yearly average of quarterly calculated covered deposits. This includes deposits up to €100,000 as defined in Article 6(1) of the DGSD, excluding temporary high balances.

- 3.1.2. Section B: Assessing Eligibility for Simplified Calculations

This section is a critical decision point for smaller institutions to determine if they can use a simplified lump-sum contribution method.

- 2B1: Invitation for Assessment: Answer “Yes” only if you have been explicitly invited by the SRB to complete the full form for an assessment under Article 10(8) of the Delegated Regulation.

- 2B2: Qualification for Lump-Sum Contribution: This field automatically determines if your institution qualifies for the lump-sum contribution based on a formula. Generally, institutions with total liabilities under €1 billion and liabilities minus own funds and covered deposits under €300 million may qualify. This is a simplified interpretation of the validation rule logic applied to this field in the official XBRL taxonomy.

- 2B3: Opting for Alternative Calculation: If you qualify for the lump-sum contribution (2B2 is “Yes”), you have a choice. Answering “Yes” here means you will complete the rest of the form so the SRB can calculate an alternative contribution. The lower of the two amounts (lump-sum vs. full calculation) will be applied. Answering “No” means the lump-sum amount will be applied, and no further information is required.

- 3.1.3. Section C: The Derivative Adjustment Process

This mandatory adjustment re-values liabilities arising from derivative contracts (excluding credit derivatives) according to a specific methodology. The process involves five key steps.

- Step 1: Identification of Netting Agreements: Identify all recognized netting agreements that fall under Articles 5a to 5e of the Delegated Regulation.

- Step 2: Carve-Out of Derivative Liabilities: Identify and separate the “liabilities arising from derivatives contracts” from your total liabilities (2A1). The source for this value must be your annual financial statements to ensure consistency.

- Step 3: Calculation of Exposure Value: Calculate the exposure value for these derivative liabilities. You must use the Mark-to-Market Method (Article 5b) or, if your institution meets the conditions in Article 273a(2) of the CRR, you may use the Simplified Exposure Method (Article 5c). This calculation is performed on a quarterly basis to derive a yearly average.

- Step 4: Application of the 75% Floor: Calculate a floor amount by multiplying the total accounting value of derivative liabilities (both on- and off-balance sheet) by 75%. If this floor amount is higher than the exposure value calculated in Step 3, the floor amount must be used instead.

- Step 5: Final Adjustment of Total Liabilities: The final adjusted total liabilities are calculated using the following formula: Total Liabilities (2A1) – Accounting Value of On-Balance Sheet Derivatives (2C2) + Adjusted/Floored Derivative Value (2C5)

- 3.1.4. Reporting Derivative Adjustment Figures

The following table details the fields used to report the derivative adjustment.

| Field ID | Field Name | Calculation/Source |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | The yearly average of quarterly amounts calculated as per Step 3 above. |

| 2C2 | Accounting value of liabilities arising from all derivative contracts (excluding credit derivatives) booked on-balance sheet, when applicable | The on-balance sheet value of derivative liabilities from your annual financial statements. |

| 2C3 | Accounting value of liabilities arising from all derivative contracts (excluding credit derivatives) held off-balance sheet, when applicable | The absolute value of negative fair values for off-balance sheet derivatives. |

| 2C4 | Total accounting value of liabilities arising from all derivative contracts (excluding credit derivatives) | 2C2 + 2C3 |

| 2C5 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e Delegated Regulation after floor | MAX(2C1, 75% * 2C4) |

| 2C6 | Total liabilities after adjustment of liabilities arising from all derivative contracts (excluding credit derivatives) | 2A1 – 2C2 + 2C5 |

After establishing the adjusted total liabilities, the next logical step is to identify and calculate any permissible deductions as detailed in Tab 3.

4.0 Step-by-Step Guide to Tab 3: Calculating Deductions (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

4.1. Refining the Base: Applying Permissible Liability Deductions(for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period)

Tab 3 allows you to reduce your contribution base by deducting specific, qualifying liabilities. Each deduction category has precise criteria and a specific calculation methodology that must be followed carefully, particularly concerning the consistent treatment of derivatives as established in Tab 2.

4.1.1. Section A: Qualifying Liabilities from Clearing Activities

This section is for deducting liabilities related to clearing activities as defined in Article 2(3) of EMIR. This applies to institutions that answered “Yes” to field 1C5.

| Field ID | Field Name | Purpose/Formula Summary |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | Starting total from which derivative liabilities for this section are identified. |

| 3A1 | Of which: qualifying liabilities arising from derivatives related to clearing activities (yearly average of the quarterly calculated amounts). | The portion of 2C1 that relates to clearing activities. |

| 3A3 | Derivative floor factor | IF(2C1<>0, 2C5/2C1, 0) – This prorates the floor adjustment from Tab 2. |

| 3A4 | Adjusted value of qualifying liabilities related to clearing activities arising from derivatives | 3A1 * 3A3 – The adjusted value of the derivative component. |

| 3A5 | Total accounting value of qualifying liabilities related to clearing activities | The total accounting value of clearing liabilities from your financial statements. |

| 3A7 | Of which: not arising from derivatives | 3A5 – 3A6 – The non-derivative portion of clearing liabilities. |

| 3A8 | Total deductible amount of qualifying liabilities related to clearing activities | 3A7 + 3A4 – The final deductible amount for this category. |

4.1.2. Section B: Qualifying Liabilities from Central Securities Depository (CSD) Activities

This section allows for the deduction of liabilities related to CSD activities, applicable to institutions that answered “Yes” to field 1C6.

| Field ID | Field Name | Purpose/Formula Summary |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | Starting total from which derivative liabilities for this section are identified. |

| 3B1 | Of which: qualifying liabilities arising from derivatives related to CSD activities (yearly average of the quarterly calculated amounts). | The portion of 2C1 that relates to CSD activities. |

| 3B4 | Adjusted value of qualifying liabilities related to CSD activities arising from derivatives | 3B1 * 3B3 – The adjusted value of the derivative component. |

| 3B7 | Of which: not arising from derivatives | 3B5 – 3B6 – The non-derivative portion of CSD liabilities. |

| 3B8 | Total deductible amount of qualifying liabilities related to CSD activities | 3B7 + 3B4 – The final deductible amount. |

4.1.3. Section C: Qualifying Liabilities from Holding Client Assets or Money

This section is for deducting liabilities that arise from holding client assets or money, including on behalf of UCITS or AIFs. This applies to investment firms that answered “Yes” to field 1C7.

| Field ID | Field Name | Purpose/Formula Summary |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | Starting total from which derivative liabilities for this section are identified. |

| 3C1 | Of which: qualifying liabilities arising from derivatives that arise by virtue of holding client assets or client money (yearly average of the quarterly calculated amounts). | The portion of 2C1 that relates to holding client assets. |

| 3C4 | Adjusted value of qualifying liabilities that arise by virtue of holding client assets or client money arising from derivatives | 3C1 * 3C3 – The adjusted value of the derivative component. |

| 3C7 | Of which: not arising from derivatives | 3C5 – 3C6 – The non-derivative portion of these liabilities. |

| 3C8 | Total deductible amount of qualifying liabilities that arise by virtue of holding client assets or client money | 3C7 + 3C4 – The final deductible amount. |

4.1.4. Section D: Qualifying Liabilities from Promotional Loans

This section allows for the deduction of liabilities arising from promotional loans for institutions that answered “Yes” to field 1C9.

| Field ID | Field Name | Purpose/Formula Summary |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | Starting total from which derivative liabilities for this section are identified. |

| 3D1 | Of which: qualifying liabilities arising from derivatives that arise from promotional loans (yearly average of the quarterly calculated amounts). | The portion of 2C1 related to promotional loans. |

| 3D4 | Adjusted value of qualifying liabilities that arise from promotional loans arising from derivatives | 3D1 * 3D3 – The adjusted value of the derivative component. |

| 3D7 | Of which: not arising from derivatives | 3D5 – 3D6 – The non-derivative portion. |

| 3D8 | Total deductible amount of qualifying liabilities that arise from promotional loans | 3D7 + 3D4 – The final deductible amount. |

4.1.5. Section E: Qualifying Institutional Protection Scheme (IPS) Liabilities

This section is for deducting liabilities created through agreements with another member of the same qualified IPS.

| Field ID | Field Name | Purpose/Formula Summary |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | Starting total from which derivative liabilities for this section are identified. |

| 3E1 | Of which: qualifying IPS liabilities arising from derivatives that arise from a qualifying IPS member (yearly average of the quarterly calculated amounts). | The portion of 2C1 related to transactions with other IPS members. |

| 3E8 | Adjusted value of total qualifying IPS liabilities | 3E7 + 3E4 – The total adjusted value of IPS liabilities owed by your institution. |

| 3E10 | Adjusted value of total qualifying IPS assets (yearly average of the quarterly calculated amounts). | The corresponding adjusted value of IPS assets held by your institution. |

| 3E11 | Total deductible amount of assets and liabilities arising from qualifying IPS liabilities | (3E8 + 3E10) / 2 – The final deductible amount. |

This calculation applies the principle of even deduction as mandated by Article 5(2) of the Delegated Regulation. For a deduction to be valid, the reported asset must correspond to an eligible liability for the IPS counterparty. In the event of a mismatch between the reported asset value and the liability value, the value reported by the counterparty as a liability prevails. The derivative adjustment, including the 75% floor, is prorated and applied to the derivative component of these liabilities. The final deductible amount for each institution is calculated by summing the adjusted values of the qualifying assets and liabilities for the transaction and dividing by two, ensuring the deduction is split evenly between the two parties.

4.1.6. Section F: Qualifying Intragroup Liabilities

This section allows for the deduction of liabilities from transactions with an institution that is part of the same group and included in the same consolidated supervision.

| Field ID | Field Name | Purpose/Formula Summary |

| 2C1 | Liabilities arising from all derivative contracts (excluding credit derivatives) valued in accordance with the Articles 5a to 5e of Delegated Regulation (yearly average of the quarterly calculated amounts). | Starting total from which derivative liabilities for this section are identified. |

| 3F1 | Of which: qualifying intragroup liabilities arising from derivatives (yearly average of the quarterly calculated amounts). | The portion of 2C1 related to transactions with other group members. |

| 3F8 | Adjusted value of total qualifying intragroup liabilities | 3F7 + 3F4 – The total adjusted value of intragroup liabilities owed by your institution. |

| 3F10 | Adjusted value of total qualifying intragroup assets (yearly average of the quarterly calculated amounts). | The corresponding adjusted value of intragroup assets held by your institution. |

| 3F11 | Total deductible amount of assets and liabilities arising from qualifying intragroup liabilities | (3F8 + 3F10) / 2 – The final deductible amount. |

Similar to IPS liabilities, intragroup deductions are subject to the principle of even deduction. An institution must identify intragroup assets that correspond to an eligible intragroup liability for the counterparty. If there is a mismatch in reported values, the liability value reported by the counterparty takes precedence. The derivative adjustment and its corresponding floor are applied proportionally to the derivative portion of the liabilities. The total value of the qualifying transaction (both the asset and the liability, after adjustments) is summed, and each institution deducts half of the total, ensuring the deduction is evenly distributed.

4.1.7. Section G: Simplified Calculation Methods

This section confirms eligibility for simplified calculation methods by referencing the answers given in fields 1C8 and 1C10, which identify specific types of investment firms and mortgage credit institutions.

Once all applicable deductions have been calculated, the final phase of reporting involves providing the risk indicators that will adjust the basic contribution.

5.0 Step-by-Step Guide to Tab 4: Risk Adjustment Indicators (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

5.1. Risk Profiling: Reporting the Key Risk Indicators (for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period)

Tab 4 collects the key risk indicators used by the SRB to calculate the risk-adjusted portion of your contribution. It is critically important to determine the correct reporting level for each indicator. If a waiver has been granted by your competent authority, you may report at a consolidated or sub-consolidated level; otherwise, data must be provided at the individual entity level.

- 5.1.1. Section A: “Risk Exposure” Pillar

This section measures risk exposure through leverage and capital adequacy ratios.

- Leverage Ratio: You must first answer the waiver question (4A1). If a waiver applies, you will specify the reporting level (consolidated or sub-consolidated in 4A2) and provide parent information. If no waiver applies, you must report the Leverage Ratio (4A7) at the individual level.

- CET1 Ratio and TRE/TA: The process is similar for the Common Equity Tier 1 (CET1) ratio. After answering the waiver question (4A8) and selecting the reporting level (4A9), you must provide the underlying data points: CET1 Capital (4A14), Total Risk Exposure (4A15), and Total Assets (4A17).

- 5.1.2. Section B: “Stability and Variety of Sources of Funding” Pillar

This section assesses funding stability.

- After addressing the waiver questions, you must report the Liquidity Coverage Ratio (LCR) in field 4B6 and the Net Stable Funding Ratio (NSFR) in field 4B12 at the appropriate reporting level (individual or liquidity sub-group).

- 5.1.3. Section C: “Importance to the Financial System” Pillar

This section measures systemic importance through interconnectedness.

- Based on the waiver question (4C1), you will determine the reporting level and then provide the Total amount of interbank loans (4C6) and Total amount of interbank deposits (4C7).

- Interbank loans (4C6) are defined as the sum of carrying amounts of loans and advances to credit institutions and other financial corporations, determined by summing specific cells from multiple FINREP templates: SUM({F_04.01; SUM(r150,r160); c010}, {F_04.02.1; SUM(r140,r150); c010}, {F_04.02.2; SUM(r150,r160); c010}, {F_04.03.1; SUM(r140,r150); c010}, {F_04.04.1; SUM(r100,r110); c010}, {F_04.06; SUM(r150,r160); c010}, {F_04.07; SUM(r150,r160); c010}, {F_04.08; SUM(r150,r160); (c010,c035)}, {F_04.09; SUM(r100,r110); c050}, {F_04.10; SUM(r150,r160); c010}).

- Interbank deposits (4C7) are defined as the carrying amount of deposits from credit institutions and other financial corporations, determined from FINREP template F 08.01: {F_08.01.a; SUM(r160,r210); SUM(c010,c020,c030,c034,c035)}.

- 5.1.4. Section D: “Additional Risk Indicators” Pillar

This section captures several other risk factors determined by the resolution authority.

- Market risk on traded instruments (4D1): The risk exposure amount for market risk on traded debt and equity instruments.

- Total off-balance sheet nominal amount (4D5): The total nominal amount of off-balance sheet items.

- Total derivative exposure (4D9): The total exposure value of derivative contracts, with a separate field (4D10) to identify the portion cleared through a CCP. The final risk indicator for this measure is calculated using the formula: (4D9 – 4D10 * 50%) / 4A15.

- Membership in an Institutional Protection Scheme (1C3, 1C4, 4D14): Confirms IPS membership and requires the name of the IPS if applicable, linking back to information provided in Tab 1.

- Status regarding previous extraordinary public financial support (4D17): Indicates whether the institution meets three specific conditions at the reference date:

- a) The institution is part of a group that has been put under restructuring after receiving any State or equivalent funds such as from a resolution financing arrangement;

- b) The institution is part of a group that is still within the restructuring or winding down or liquidation period; and

- c) The institution is part of a group that is not in the last 2 years of implementation of the restructuring plan.

The completion of this section marks the end of the primary data entry process.

6.0 Conclusion and Final Steps (under Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance)

6.1. Ensuring a Compliant Submission (for completing the Data Reporting Form for the 2026 Single Resolution Fund (SRF) Contribution Period)

You have now journeyed through the entire reporting form—from establishing general instructions and institutional identity to performing the detailed calculations for the basic contribution, applying deductions, and reporting risk adjustment indicators. The core objective throughout this process is to ensure an accurate, compliant, and timely submission that correctly reflects your institution’s financial position and risk profile.

Before finalizing your submission, perform a final review for consistency and completeness. Address any remaining questions to your National Resolution Authority. Finally, submit the completed XBRL form according to the specific modalities and deadlines defined by that authority.

7.0 Official Documents and Annexes

The official circular and all related annexes are available on the CSSF website. These documents provide the complete technical details and reporting templates.

• Direct Link: Circular CSSF-CODERES 25/21 and its annexes

• Available Annexes under Circular CSSF-CODERES 25/21 Include:

◦ Annex 1 – Circular CSSF-CODERES 25/21 Annex 1 – 2026 Kick-off letter

◦ Annex 2 – Circular CSSF-CODERES 25/21 Annex 2 – Decision on the Data Reporting Form and Additional Assurance

◦ Annex 3a – Circular CSSF-CODERES 25/21 Annex 3a – Data reporting form (PDF version)

◦ Annex 3b – Circular CSSF-CODERES 25/21 Annex 3b – Data reporting form (Excel version)

◦ Annex 4 – Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance

◦ Annex 5 – Circular CSSF-CODERES 25/21 Annex 5 – User Guide – Ex-ante Contributions Reporting – Version 1.4

◦ Annex 6 – Circular CSSF-CODERES 25/21 Annex 6 – List of credit institutions under direct ECB supervision

◦ Annex 7a – Circular CSSF-CODERES 25/21 Annex 7a – Additional Assurance requirements 2026 (PDF version)

◦ Annex 7b – Circular CSSF-CODERES 25/21 Annex 7b – Additional Assurance requirements 2026 (Word version)

Appendix A: Key Legal References

| Abbreviation | Full Title and Link |

| SRM Regulation | Regulation (EU) No 806/2014 of the European Parliament and of the Council of 15 July 2014 establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund Link: http://data.europa.eu/eli/reg/2014/806/2024-11-14 |

| BRRD | Directive 2014/59/EU of the European Parliament and of the Council of 15 May 2014 establishing a framework for the recovery and resolution of credit institutions and investment firms Link: http://data.europa.eu/eli/dir/2014/59/2025-01-17 |

| Delegated Regulation | Commission Delegated Regulation (EU) 2015/63 of 21 October 2014 supplementing Directive 2014/59/EU of the European Parliament and of the Council with regard to ex ante contributions to resolution financing arrangements Link: http://data.europa.eu/eli/reg_del/2015/63/2024-03-21 |

| Implementing Regulation | Council Implementing Regulation (EU) 2015/81 of 19 December 2014 specifying uniform conditions of application of Regulation (EU) No 806/2014 of the European Parliament and of the Council with regard to ex ante contributions to the Single Resolution Fund Link: https://data.europa.eu/eli/reg_impl/2015/81/oj |

| CRR | Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 Link: http://data.europa.eu/eli/reg/2013/575/2025-01-01 |

| CRD | Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms Link: http://data.europa.eu/eli/dir/2013/36/2025-01-17 |

| EU COREP FINREP Regulation | Commission Implementing Regulation (EU) 2021/451 of 17 December 2020 laying down implementing technical standards for the application of Regulation (EU) No 575/2013 of the European Parliament and of the Council with regard to supervisory reporting of institutions and repealing Implementing Regulation (EU) No 680/2014 Link: http://data.europa.eu/eli/reg_impl/2021/451/2024-09-01 |

| Directive 2014/49/EU (DGSD) | Directive 2014/49/EU of 16 April 2014 on deposit guarantee schemes Link: https://data.europa.eu/eli/dir/2014/49/2014-07-02 |

| EMIR | Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories Text with EEA relevance Link: http://data.europa.eu/eli/reg/2012/648/2025-01-17 |

| MiFID | Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU Text with EEA relevance Link: http://data.europa.eu/eli/dir/2014/65/2025-01-17 |

| CSDR | Regulation (EU) No 909/2014 of the European Parliament and of the Council of 23 July 2014 on improving securities settlement in the European Union and on central securities depositories and amending Directives 98/26/EC and 2014/65/EU and Regulation (EU) No 236/2012 Text with EEA relevance Link: http://data.europa.eu/eli/reg/2014/909/2025-01-17 |

This news related to Circular CSSF-CODERES 25/21 and Single Resolution Fund (SRF) in Luxembourg can be considered as beneficial under CSSF-Circulars, Credit Institutions News, Investment Firms News, Must Read, Explanation. The pre-filled example templates for multiple CSSF Circulars and EU regulations will be available at https://ratiofy.lu/templates/ from Christmas 2025.