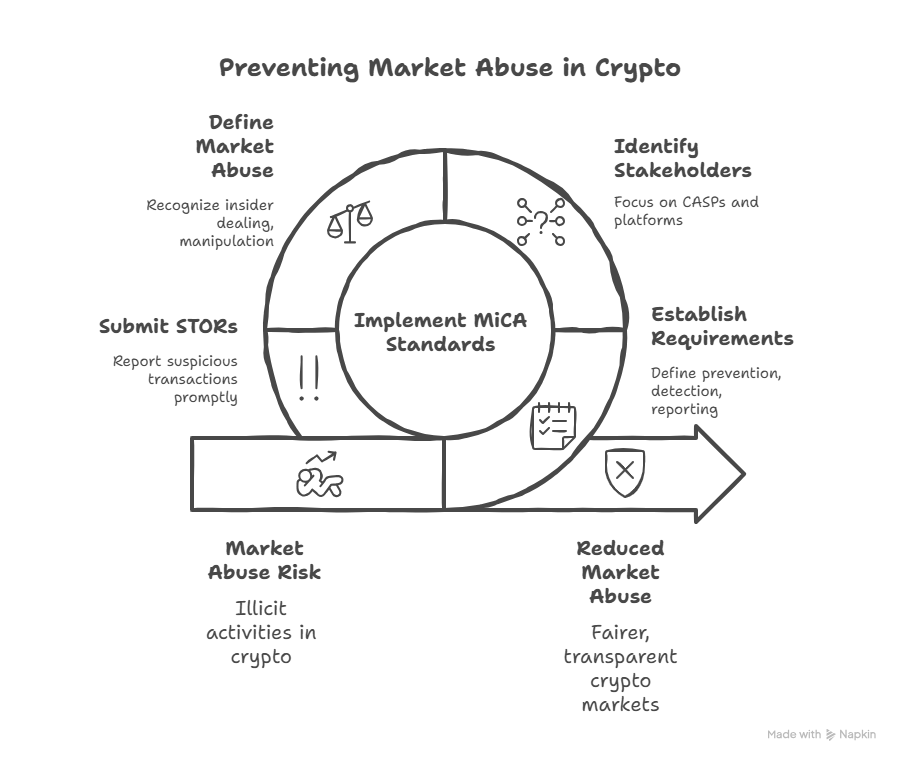

Luxembourg Financial Regulatory News: The European Union’s latest regulatory framework, the Commission Delegated Regulation (EU) 2025/885 of 29 April 2025 (supplementing Regulation (EU) 2023/1114 – Markets in Crypto-Assets (MiCA/MiCAR)) on Market Abuse available at https://www.cssf.lu/en/Document/commission-delegated-regulation-eu-2025-885-of-29-april-2025/, is now in effect, marking a pivotal moment for crypto-asset service providers and financial institutions. Far from a simple compliance checklist, this regulation represents a strategic mandate to actively protect market integrity, mitigate substantial legal risks, and solidify client trust in the burgeoning digital asset economy.

The new rules abandon a singular approach in favor of a dual-layered detection system. They mandate the establishment of robust, automated monitoring systems as the first line of defense, designed to generate real-time alerts on suspicious transactions and DLT behavior. However, the true cornerstone of the regulation lies in the second layer: expert human analysis. Trained staff are now required to conduct meticulous investigations, applying contextual judgment to determine if a “reasonable suspicion” of market abuse exists before a formal report is filed.

Under Commission Delegated Regulation (EU) 2025/885 of 29 April 2025 (supplementing Regulation (EU) 2023/1114 – Markets in Crypto-Assets (MiCA/MiCAR)), reporting a Suspicious Transaction and Order Report (STOR) requires a comprehensive and factual assessment. The regulation assigns the highest weight to the Factual Basis and Human Analysis, recognizing them as the non-negotiable core of any report. A suspicion cannot be formed without a documented analysis by a trained human. While Confidentiality is also a hard rule, key contextual factors like Past Activity and Public Info Analysis are considered crucial supporting elements. These data points can significantly strengthen a case, but they are supplementary to the foundational elements, a hierarchy reflected in their relative importance within the regulatory framework.

Finally, the Commission Delegated Regulation (EU) 2025/885 of 29 April 2025 (supplementing Regulation (EU) 2023/1114 – Markets in Crypto-Assets (MiCA/MiCAR)) clarifies that while certain detection functions may be delegated or outsourced, ultimate responsibility for compliance remains with the organization. This firm stance on accountability reinforces the need for strong internal governance, mandatory staff training, and rigorous documentation of all systems and procedures. For Luxembourg’s financial institutions, this represents a clear call to action to not only comply with the letter of the law but also to embrace a proactive, end-to-end approach to market surveillance.

Entry into Force:

This Commission Delegated Regulation (EU) 2025/885 of 29 April 2025 (supplementing Regulation (EU) 2023/1114 – Markets in Crypto-Assets (MiCA/MiCAR)) enters into force on the twentieth day following its publication in the Official Journal of the European Union and is directly applicable in all Member States.

This news for Commission Delegated Regulation (EU) 2025/885 of 29 April 2025 (supplementing Regulation (EU) 2023/1114 – Markets in Crypto-Assets (MiCA/MiCAR)) can be considered beneficial under Crypto-Assets Service Providers (CASPs) and Virtual Asset Service Providers (VASPs) News, Central Securities Depositories (CSDs) News, Credit Institutions News, EU Regulations, Issuers of Tokens (EMTs, ARTs) News, Payment Institutions (PIs) / Electronic Money Institutions (EMIs) /AISPs News, Undertakings for collective investment (UCIs)

The pre-filled example templates for many CSSF Circulars and EU regulations should be available at https://ratiofy.lu/templates/ from Christmas 2025.