Luxembourg Financial Regulatory News:

Why Does Europe’s Top Bank Watch Over Certain Banks? A Look at the ECB’s Role

We have analysed and have created this Circular CSSF-CODERES 25/21 Annex 6 explainer for understanding the list of credit institutions in Luxembourg under direct ECB supervision

1. Introduction: Setting the Stage for Bank Supervision – List of Credit Institutions in Luxembourg under Direct ECB Supervision

Think of the financial system as a high-stakes sports game. To ensure the game is fair, safe, and stable, you need a referee who enforces the rules for all the players. In the world of European banking, the European Central Bank (ECB) acts as the main “referee” or supervisor for the most important banks in the Eurozone.

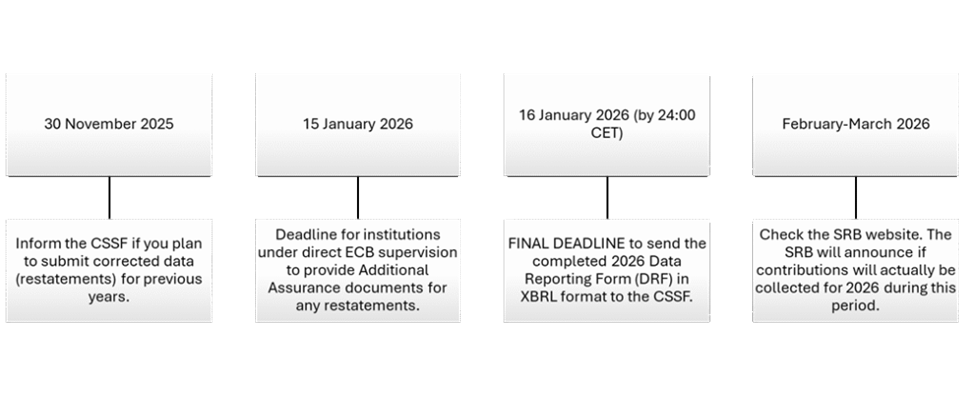

Diagram: Critical deadlines you need to meet under Circular CSSF-CODERES 25/21

By examining the real List of Credit Institutions in Luxembourg under Direct ECB Supervision, we will understand the simple but powerful logic that determines which banks require Europe’s highest level of oversight. To see this in action, let’s look at a specific list of banks that are under the ECB’s direct watch.

2. A Real-World Example: List of Credit Institutions in Luxembourg Under the ECB’s Eye

The following table shows a selection of List of Credit Institutions in Luxembourg under Direct ECB Supervision, using their official identification number from Luxembourg’s national supervisor, the Commission de Surveillance du Secteur Financier (CSSF). This list provides our primary clue for understanding the ECB’s focus and priorities.

| CSSF Number | Name of Credit Institution |

| 3 | BGL BNP Paribas |

| 14 | ING Luxembourg |

| 19 | Société Générale Luxembourg |

| 36 | Deutsche Bank Luxembourg S.A. |

| 87 | Intesa Sanpaolo Bank Luxembourg S.A. |

| 147 | HSBC Private Bank (Luxembourg) S.A. |

| 158 | UniCredit International Bank (Luxembourg) SA |

| 411 | CaixaBank Wealth Management Luxembourg S.A. |

This selection is important because not all banks in Luxembourg are on this list. Smaller, purely domestic banks are typically watched over by their national authority—in this case, the CSSF. The fact that the ECB has hand-picked these specific institutions tells us they are special cases.

For the complete list of credit institutions in Luxembourg under direct ECB supervision – Circular CSSF-CODERES 25/21 Annex 6, please refer to the official link at Circular CSSF-CODERES 25/21 Annex 6 – List of credit institutions under direct ECB supervision

Now that we’ve seen some of the names on the list, what can we deduce about them?

3. Decoding the List: Identifying the Pattern behind the List of Credit Institutions in Luxembourg under Direct ECB Supervision

By analyzing the names in the table, a clear pattern begins to emerge. We can make two key observations about these institutions (List of Credit Institutions in Luxembourg under Direct ECB Supervision).

- Observation 1: They are Major Financial Players Many of these names—like BNP Paribas, Deutsche Bank, HSBC, and Société Générale—belong to massive, global banking groups. These are not small, local banks; they are giants in the international financial industry.

- Observation 2: They have International Reach The presence of these major international brands in Luxembourg, a significant European financial hub, indicates that they conduct substantial business across national borders. Their operations are not confined to a single country.

These two observations lead to a powerful insight: a bank’s sheer size (Observation 1) combined with its cross-border operations (Observation 2), possibly makes it “systemically important.” The ECB clearly prioritizes its direct supervision on these institutions whose stability is crucial not just for one country, but for the wider European economy.

Understanding which banks are chosen leads to the most important question: why does this direct supervision matter so much?

4. The “So What?”: Why ECB Direct Supervision is Important for Everyone

The reason the ECB focuses on these large, interconnected banks comes down to one critical concept: systemic risk. Imagine a line of dominoes. If one of the largest dominoes at the front of the line falls, it’s likely to set off a chain reaction, knocking down many others. In the financial world, the failure of a huge, cross-border bank could trigger a similar crisis, threatening the stability of the entire system, impacting businesses, and endangering the savings of ordinary people.

The ECB’s direct supervision is a proactive measure designed to prevent that first domino from falling. By closely monitoring the health of these major institutions, the ECB works to ensure they are resilient and well-managed, thereby protecting the economy and citizens across Europe.

Let’s summarize the key takeaway from our investigation.

5. Conclusion: The Main Takeaway in a Nutshell

The European Central Bank directly supervises a select group of the largest and most interconnected banks—like those we saw on the Luxembourg list—because their health is fundamental to the financial stability of the entire European system. By acting as the primary supervisor for these key players, the ECB helps safeguard the economy for everyone.

6. Official Documents and Annexes

The official circular and all related annexes are available on the CSSF website. These documents provide the complete technical details and reporting templates.

• Direct Link: Circular CSSF-CODERES 25/21 and its annexes

• Available Annexes under Circular CSSF-CODERES 25/21 Include:

◦ Annex 1 – Circular CSSF-CODERES 25/21 Annex 1 – 2026 Kick-off letter

◦ Annex 2 – Circular CSSF-CODERES 25/21 Annex 2 – Decision on the Data Reporting Form and Additional Assurance

◦ Annex 3a – Circular CSSF-CODERES 25/21 Annex 3a – Data reporting form (PDF version)

◦ Annex 3b – Circular CSSF-CODERES 25/21 Annex 3b – Data reporting form (Excel version)

◦ Annex 4 – Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance

◦ Annex 5 – Circular CSSF-CODERES 25/21 Annex 5 – User Guide – Ex-ante Contributions Reporting – Version 1.4

◦ Annex 6 – Circular CSSF-CODERES 25/21 Annex 6 – List of credit institutions under direct ECB supervision

◦ Annex 7a – Circular CSSF-CODERES 25/21 Annex 7a – Additional Assurance requirements 2026 (PDF version)

◦ Annex 7b – Circular CSSF-CODERES 25/21 Annex 7b – Additional Assurance requirements 2026 (Word version)

This news related to Circular CSSF-CODERES 25/21 and Single Resolution Fund (SRF) in Luxembourg can be considered as beneficial under CSSF-Circulars, Credit Institutions News, Investment Firms News, Must Read, Explanation.

The pre-filled example templates for multiple CSSF Circulars and EU regulations will be available at https://ratiofy.lu/templates/ from Christmas 2025.