Luxembourg Financial Regulatory News:

We have analysed and have created this Circular CSSF-CODERES 25/21 explainer as your clear-cut guide on the CSSF’s recent data collection request. The purpose of this article is to simplify and explain the key requirements outlined in Circular CSSF-CODERES 25/21. If you are a Compliance Officer or work for a credit institution in Luxembourg, this guide will clarify exactly what your institution needs to do, why it’s necessary, and the critical deadlines you need to meet.

Let’s understand the CSSF Requirements under Circular CSSF-CODERES 25/21 for the 2026 Single Resolution Fund (SRF) Contribution in Luxembourg:

1. What is this Circular About? The Big Picture

1.1 The Single Resolution Fund (SRF): The ‘Why’

At its core, the Single Resolution Fund (SRF) in Luxembourg is a financial safety net. Its primary purpose is to ensure that a failing bank within the European Union’s Banking Union can be managed in an orderly way (a process called “resolution”) without using taxpayer money or causing financial instability. All banks in the Banking Union contribute to this fund.

Under Circular CSSF-CODERES 25/21, this data collection is happening now to prepare for the 2026 contribution period. While contributions were collected annually to build the fund to its target level, they are now only collected if the fund’s total financial resources fall below a specific threshold—1% of all covered deposits across the Banking Union. The data you provide will be used to calculate your institution’s potential contribution if one is required.

1.2 Key Organisations and Their Roles

Three main players are involved in this process. Understanding their roles is key to understanding the workflow under Circular CSSF-CODERES 25/21.

| Organisation | Full Name | Their Role in this Process |

| SRB | Single Resolution Board | The central EU authority that manages the Single Resolution Fund (SRF). It requests the necessary data and calculates each institution’s potential contribution. |

| CSSF | Commission de Surveillance du Secteur Financier | Luxembourg’s financial regulator. It acts as the local coordinator, collecting the data from all relevant institutions in Luxembourg and forwarding it to the SRB. |

| Your Institution | Credit Institution | Responsible for accurately completing the data forms and submitting them to the CSSF on time. |

Now that we understand the purpose of the Single Resolution Fund (SRF) in Luxembourg and the key players, let’s determine if your institution needs to take action.

2. Who Needs to Report?

The Circular CSSF-CODERES 25/21 does not apply to every financial entity in Luxembourg. It is crucial to first identify if your institution falls within the scope of this request.

2.1 Institutions in Scope

Your institution is required to report under Circular CSSF-CODERES 25/21 if it is a:

- Credit institution established in Luxembourg.

- Certain investment firms in Luxembourg.

2.2 Institutions NOT in Scope

You are not required to respond to this specific Circular CSSF-CODERES 25/21 if your institution is a:

• Branch in Luxembourg whose head office is located outside the European Union.

• Branch in Luxembourg whose head office is located in another Member State of the EU. (These branches are covered by their head office’s reporting.)

If your institution is in scope, the next section details your specific responsibilities.

3. Your Core Tasks: The Data Reporting Process for 2026

The process involves a specific submission format and carries significant consequences for non-compliance under Circular CSSF-CODERES 25/21.

3.1 The Main Task: Submitting the Data Reporting Form (DRF)

Your primary responsibility is to complete and submit the Data Reporting Form (DRF) to the CSSF.

• Required Format: The submission must be in XBRL format.

• Delivery Methods: You can transmit the XBRL file through one of two channels:

◦ The API solution (S3 technology)

◦ The eDesk digital portal

3.2 What Happens if You Don’t Comply?

Failing to transmit the required information correctly and on time can lead to serious penalties, as outlined in Article 17 of Commission Delegated Regulation (EU) 2015/63. Specifically, the SRB may:

• Use its own estimates or assumptions to calculate your institution’s contribution. This could result in an inaccurate, and likely higher, calculation.

• Assign your institution to the highest risk category, which would directly increase the amount of your calculated contribution.

Given these risks, adhering to the official timeline is essential.

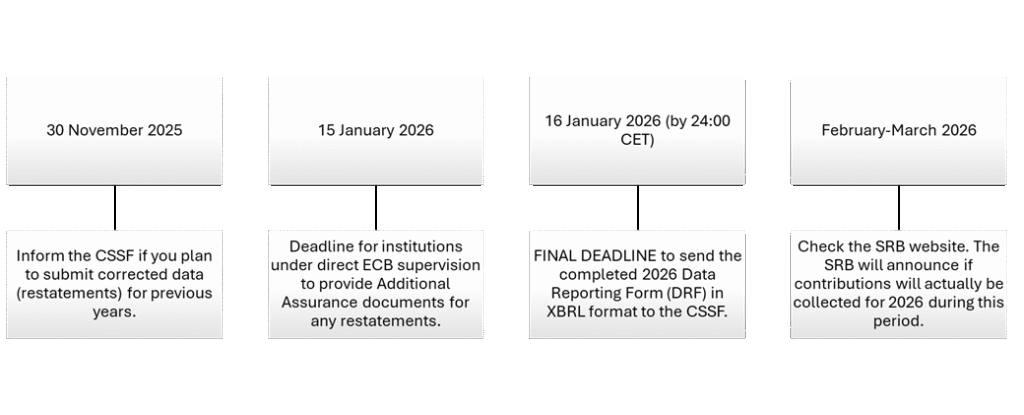

4. Key Deadlines: A Clear Timeline

Mark your calendar. The following dates are critical for ensuring compliance.

| Date | Action Required |

| 30 November 2025 | Inform the CSSF if you plan to submit corrected data (restatements) for previous years. |

| 15 January 2026 | Deadline for institutions under direct ECB supervision to provide Additional Assurance documents for any restatements. |

| 16 January 2026 (by 24:00 CET) | FINAL DEADLINE to send the completed 2026 Data Reporting Form (DRF) in XBRL format to the CSSF. |

| February-March 2026 | Check the SRB website. The SRB will announce if contributions will actually be collected for 2026 during this period. |

Beyond the standard data submission, some institutions face additional obligations.

5. Special Cases and Additional Requirements

Pay close attention to this section if your institution is under direct ECB supervision or needs to correct past data.

5.1 Additional Assurance (AA) Documents

“Additional Assurance” refers to a confirmation provided by an external auditor based on specific, agreed-upon procedures (AUP).

• Who does this apply to?

◦ Institutions that are, either directly or as part of a group, under direct European Central Bank (ECB) supervision.

• Is it required for the 2026 data submission?

◦ Conditionally. To reduce the burden on banks, these documents are only required for the 2026 data if the SRB officially decides to collect contributions. The CSSF will issue a separate circular to notify you if this becomes necessary.

5.2 Correcting Past Data (Restatements)

“Restatements” are corrections to data submitted in previous years.

• You must inform the CSSF of your intent to submit restatements by 30 November 2025.

• Important: Unlike the 2026 data, the conditional rule for Additional Assurance does not apply to restatements. If your institution is under direct ECB supervision, you must provide the Additional Assurance documents for your restated data by 15 January 2026.

However, there is an important exception. A new AUP report from an auditor is not required for the restated data if all of the following conditions are met:

• The restatement is a direct result of a finding in an auditor’s report from a previous cycle that identified the incorrect data.

• The original auditor’s report explicitly mentioned both the incorrect former figure and the correct new value that should be submitted.

• This original auditor’s report is attached to the restated DRF submission.

If you have questions or need to consult the original documents, the following resources are available.

6. Where to Find Help and Official Documents

6.1 Key Contacts

For any questions regarding this circular, you can contact the following individuals at the CSSF:

• Mr. Bertrand Toulmonde: bertrand.toulmonde@cssf.lu

• Mr. Helmi Gargouri: helmi.gargouri@cssf.lu

6.2 Official Documents and Annexes

The official circular and all related annexes are available on the CSSF website. These documents provide the complete technical details and reporting templates.

• Direct Link: Circular CSSF-CODERES 25/21 and its annexes

• Available Annexes under Circular CSSF-CODERES 25/21 Include:

◦ Annex 1 – Circular CSSF-CODERES 25/21 Annex 1 – 2026 Kick-off letter

◦ Annex 2 – Circular CSSF-CODERES 25/21 Annex 2 – Decision on the Data Reporting Form and Additional Assurance

◦ Annex 3a – Circular CSSF-CODERES 25/21 Annex 3a – Data reporting form (PDF version)

◦ Annex 3b – Circular CSSF-CODERES 25/21 Annex 3b – Data reporting form (Excel version)

◦ Annex 4 – Circular CSSF-CODERES 25/21 Annex 4 – 2026 Guidance

◦ Annex 5 – Circular CSSF-CODERES 25/21 Annex 5 – User Guide – Ex-ante Contributions Reporting – Version 1.4

◦ Annex 6 – Circular CSSF-CODERES 25/21 Annex 6 – List of credit institutions under direct ECB supervision

◦ Annex 7a – Circular CSSF-CODERES 25/21 Annex 7a – Additional Assurance requirements 2026 (PDF version)

◦ Annex 7b – Circular CSSF-CODERES 25/21 Annex 7b – Additional Assurance requirements 2026 (Word version)

7. Summary of Your Key Actions

To ensure full compliance, focus on these three critical steps:

1. Verify: First, confirm that your institution is in scope for this data collection and not one of the excluded branch types.

2. Prepare & Submit: Complete the Data Reporting Form accurately, convert it to the required XBRL format, and submit it to the CSSF before the final deadline of 16 January 2026.

3. Handle Special Cases: If you need to submit restatements or if your institution is under direct ECB supervision, be aware of the earlier deadlines and additional assurance requirements that apply to you.

This news related to Circular CSSF-CODERES 25/21 and Single Resolution Fund (SRF) in Luxembourg can be considered as beneficial under CSSF-Circulars, Credit Institutions News, Investment Firms News, Must Read, Explanation.

The pre-filled example templates for multiple CSSF Circulars and EU regulations will be available at https://ratiofy.lu/templates/ from Christmas 2025.