Luxembourg Financial Regulatory News:

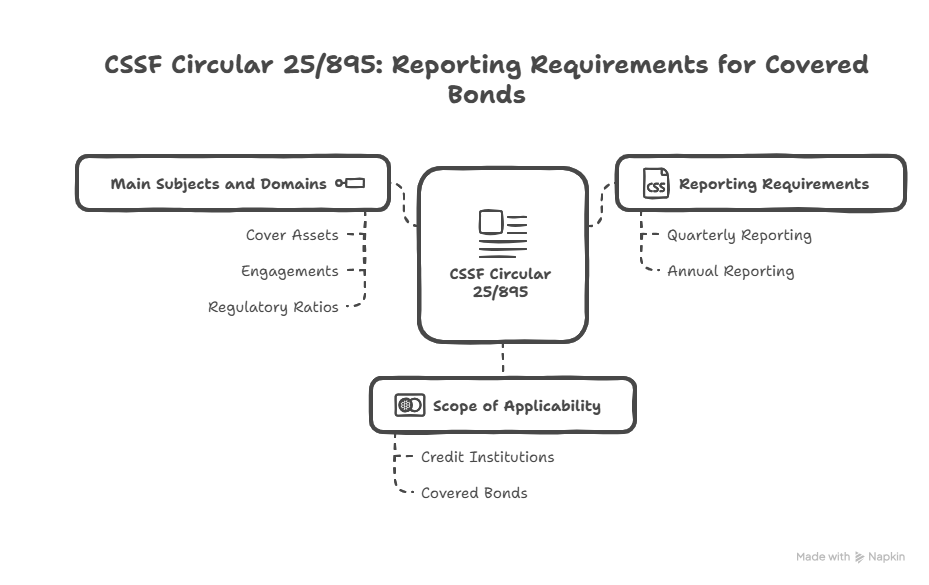

CSSF Circular 25/895, dated July 31, 2025, defines the format and procedures for credit institutions under Luxembourg law to report on their lettres de gage (covered bonds). In application of the 2021 law on covered bonds, it requires regular reporting to the CSSF. Institutions must submit quarterly data using specific Excel templates, detailing cover assets, liabilities, and key coverage ratios. Additionally, an annual free-form PDF report is required. The circular specifies reporting deadlines aligned with COREP/FINREP and details the file-naming conventions and submission process.

Read more at the official link at https://www.cssf.lu/en/Document/circular-cssf-25-895/

Basis and Inspiration for CSSF Circular 25/895

This Circular CSSF 25/895 is issued by the Commission de Surveillance du Secteur Financier (CSSF) in application of the Law of December 8, 2021, concerning the issuance of lettres de gage (covered bonds).

Scope of Applicability

Circular CSSF 25/895 applies to credit institutions under Luxembourg law that have issued lettres de gage.

Exemptions The document does not specify any exemptions for CSSF Circular 25/895.

Date of Applicability

Circular CSSF 25/895 itself is dated July 31, 2025. The deadlines for submitting data are aligned with the quarterly COREP/FINREP reporting dates, which are February 11, May 11, August 11, and November 11.

Main Subjects and Domains Covered

Circular CSSF 25/895 covers the format, content, and transmission methods for information that must be reported to the CSSF. The main domains include:

- Cover assets: This section details the types of assets that can be used to cover the lettres de gage, such as residential real estate loans, public sector exposures, and movable assets (aircraft, ships, etc.).

- Engagements related to lettres de gage: This includes the principal and interest obligations, as well as costs.

- Regulatory limits and coverage ratios: The circular specifies various ratios, such as the nominal coverage ratio and the overcollateralization ratio, that institutions must calculate and report.

High-Level Requirements

Under Circular CSSF 25/895 requirements, reporting is required on both a quarterly and annual basis.

- Quarterly reporting: Data must be submitted using the standardized .xlsx tables provided in the circular’s annex. Institutions must not change the structure of these tables.

- Annual reporting: This is to be submitted in a free-form PDF report.

- File naming: The quarterly .xlsx file must follow a specific naming convention: OTHREP-Bxxxx-LDG_Reporting_YYYY_MM.

Main Concerned Functions

The primary functions concerned by CSSF Circular 25/895 are the regulatory reporting and finance/treasury departments of the credit institutions. The circular points to the reportingbanques@cssf.lu email address for submission-related questions.

List of Required Documents

As per Circular CSSF 25/895, the financial institutions under the scope are required to prepare and submit the following:

- Quarterly Excel Tables (.xlsx): These are the pre-defined tables provided by the CSSF.

- Annual PDF Report: A free-form report covering specific points.

This news for Circular CSSF 25/895 can be considered beneficial under CSSF-Circulars, Credit Institutions News.

The pre-filled example templates for CSSF Circular 25/895 should be available at https://ratiofy.lu/templates/ from Christmas 2025.